11 Tourist Destinations Hurt the Hardest by Insurance Price Hikes

Some places sell escape on sunshine and nostalgia, yet the paperwork behind that promise has started to feel heavier. Across the U.S., rising property and liability insurance costs are landing hardest in destinations built on older buildings, coastal exposure, or wildfire risk. When premiums jump, the change does not stay in the back office. It shows up as higher room rates, fewer off-season deals, postponed repairs, and small businesses forced to choose between coverage and comfort. Visitors still come, but the cost structure underneath the experience has shifted.

Florida Keys And Key West, Florida

On the Florida Keys, the postcard view comes with serious wind and flood exposure, and insurance pricing follows fast. Guesthouses, marinas, dive operators, and small restaurants feel the squeeze when coverage jumps at renewal, because repairs cost more, contractors are limited, and materials arrive through a narrow supply chain. Owners respond with higher nightly rates, bigger deposits, and stricter cancellation rules, then cut back on upgrades that once kept older places charming. The Keys still feel easy on the surface, yet the trip has become less casual: fewer shoulder-season bargains, more add-on fees, and a growing gap between the headline rate and the final total.

Miami Beach And Greater Miami, Florida

In Miami Beach, insurance hikes start as a line item and end up reshaping how buildings, hotels, and rentals price a stay. Condo towers absorb higher master-policy costs through association fees, while hospitality operators face stricter underwriting tied to storm risk, water damage history, and building age. That pressure pushes owners toward faster retrofits and higher operating costs, which show up in resort fees, parking charges, and minimum stays. The destination remains busy, but the bargain version fades. A simple weekend can cost more than expected once taxes, fees, and insurance-driven overhead stack on top of the posted room rate.

Sanibel And Fort Myers Beach, Florida

Sanibel and Fort Myers Beach sit in a rebuild reality where storms are not hypothetical, and insurance has become part of every business plan. When premiums rise, small resorts and vacation rentals must cover the annual bill while also paying for inspections, updated code requirements, and repairs that arrive in waves rather than one clean project. Some owners rebuild, then discover the insurance baseline changes the whole math, shrinking affordable weeks and pushing longer minimum stays. The market drifts toward higher-priced inventory that can absorb the new fixed costs, and the place slowly feels less like an easy family repeat trip and more like a planned splurge.

New Orleans And The Louisiana Gulf Coast

New Orleans runs on historic buildings, packed calendars, and independent businesses that rely on predictable foot traffic. When property insurance climbs across Louisiana, hotels, music venues, and restaurants carry higher fixed costs before a single guest arrives, and many respond with higher fees, leaner staffing, or delayed maintenance in spaces that already require specialized work. Insurance pressure also complicates financing for renovations, because lenders watch coverage closely. Over time, visitors notice the shift as fewer easy deals, more pre-paid packages, and a wider gap between the advertised room rate and the final total, especially during festival seasons when demand is high and flexibility is low.

Outer Banks, North Carolina

On the Outer Banks, the tourism engine is rental homes near water, and insurance price hikes are now baked into how those homes are managed. As coastal premiums rise, owners face higher deductibles and narrower coverage options, and those costs show up in weekly rates, cleaning fees, and stricter minimum stays that reduce flexibility for shorter bookings. The ripple travels beyond lodging. Restaurants, surf shops, and charter operators depend on a broad middle of visitors, not only peak-week splurges. When insurance lifts the overall price of entry, that middle thins, shoulder seasons soften, and staffing becomes harder, even when beaches, weather, and demand still look strong on paper.

Charleston And The South Carolina Lowcountry

Charleston’s historic streets and nearby beach towns draw weddings, weekends, and food trips, but coastal insurance pricing is tightening the screws behind the scenes. As wind and flood risk becomes more expensive to cover, inns, rental homes, and small hotels have less room to keep rates steady while also funding roof upgrades, elevation steps, and stricter inspections tied to lending. The charm stays, yet the pricing gets sharper: more add-on fees, fewer off-season bargains, and more properties nudged toward higher-end guests who can absorb volatility. For workers and small operators, the pressure is constant, because insurance bills land whether occupancy is high or not.

Cape Cod And The Islands, Massachusetts

Cape Cod’s appeal is dunes, old houses, and weather that changes quickly, and insurance hikes are quietly rewriting the maintenance schedule. Coastal properties face higher premiums tied to storm exposure, salt damage, and flooding, and many owners must choose between bigger deductibles or pricier coverage while still paying for winterization, roof work, and repairs after nor’easters. Smaller inns feel it sharply because their margins are seasonal, yet the insurance bill is year-round. Visitors notice a softer form of sticker shock: a familiar week in a familiar town costs more, and the extras become less optional. The place looks the same, but the back-end costs are different.

Lake Tahoe, California And Nevada

Lake Tahoe sits in wildfire country, and that risk is reshaping insurance availability and pricing around cabins, lodges, and second homes. When carriers tighten terms or decline renewals, owners face higher premiums, more paperwork, and less predictable planning, even for well-maintained rentals used by families and ski groups. Many invest in defensible space and fire-resistant materials, but the upgrades cost money and do not always stabilize rates. The result filters into nightly pricing: more inventory pushed toward peak-week premiums, fewer midrange stays available year-round, and hosts who require larger deposits because the financial risk of one season has grown. Visitors still come for snow and lake days, but the affordability ladder has missing rungs.

Malibu And The Santa Monica Mountains, California

Malibu sells sun and scenic roads, yet it borders terrain that burns fast in dry wind, and that risk has a direct price. When coverage tightens, hillside rentals, small hotels, and event venues face higher premiums and stricter requirements, from brush clearance to roof standards and emergency access planning. Those costs appear as larger deposits, longer minimum stays, and extra service charges that make short coastal breaks feel less casual. The area still draws visitors, but the path narrows toward travelers who can absorb a higher, more complex total, while midrange options struggle to keep operating without cutting amenities or deferring improvements that once kept properties comfortable and well kept.

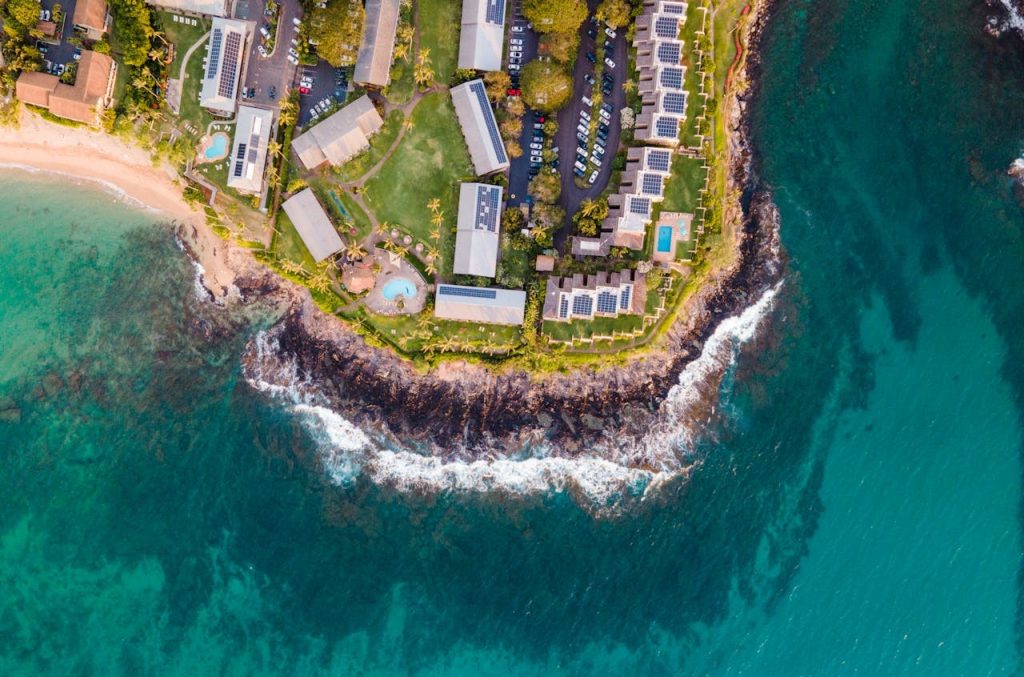

West Maui And Lahaina, Hawaii

On West Maui, insurance pressure shows up in condo association budgets, hotel operating costs, and monthly fees owners must absorb while the community rebuilds. After major disasters, insurers often reprice risk, and coastal buildings can see steep jumps that force boards to raise dues, adjust coverage, or delay upgrades that keep properties safe and attractive, from elevators to sprinklers to basic weatherproofing. For visitors, the change is steady and quiet: higher room rates, fewer discounted weeks, and more properties insisting on longer stays because fixed insurance costs do not shrink when occupancy dips. The place remains beautiful, yet the economics behind each reservation are tighter than they look.

Barrier Islands And Coastal Georgia

Along coastal Georgia, barrier island destinations rely on older homes, marsh edges, and vacation rentals that sit close to wind and water exposure. When insurance costs rise, owners face hard choices about deductibles, flood requirements, and retrofits that protect property but strain budgets, especially for smaller inns and family-run rentals. Higher coverage costs move into nightly rates, cleaning charges, and stricter booking rules, and the ripple reaches service businesses that depend on steady turnover. Over time, the destination can feel less flexible and more expensive, not because the beach changed, but because the cost of keeping a building insurable now shapes every decision.